The Financial Siege - The War on Illusion: Episode 6

Why Your “Credit Score” is a Measure of Obedience, Not Wealth

THE COGNITIVE LENS

[SYSTEM WARNING: NARRATIVE AUGMENTATION ACTIVE]

EDITOR’S NOTE: This dossier is not just a financial report; it is a psychological diagnostic. To deconstruct a system as pervasive as the “Financial Siege,” we cannot rely on a single perspective.

Throughout this text, you will encounter “Unauthorized Entries.” These are narrative interruptions featuring the Sovereign Systems Command Staff—a set of cognitive avatars representing the different aspects of the human will under siege.

Think of them as the voices in your head when you stare at a credit card bill, given form:

THE WILL (Ryuko Matoi): The raw, defiant rage against the machine.

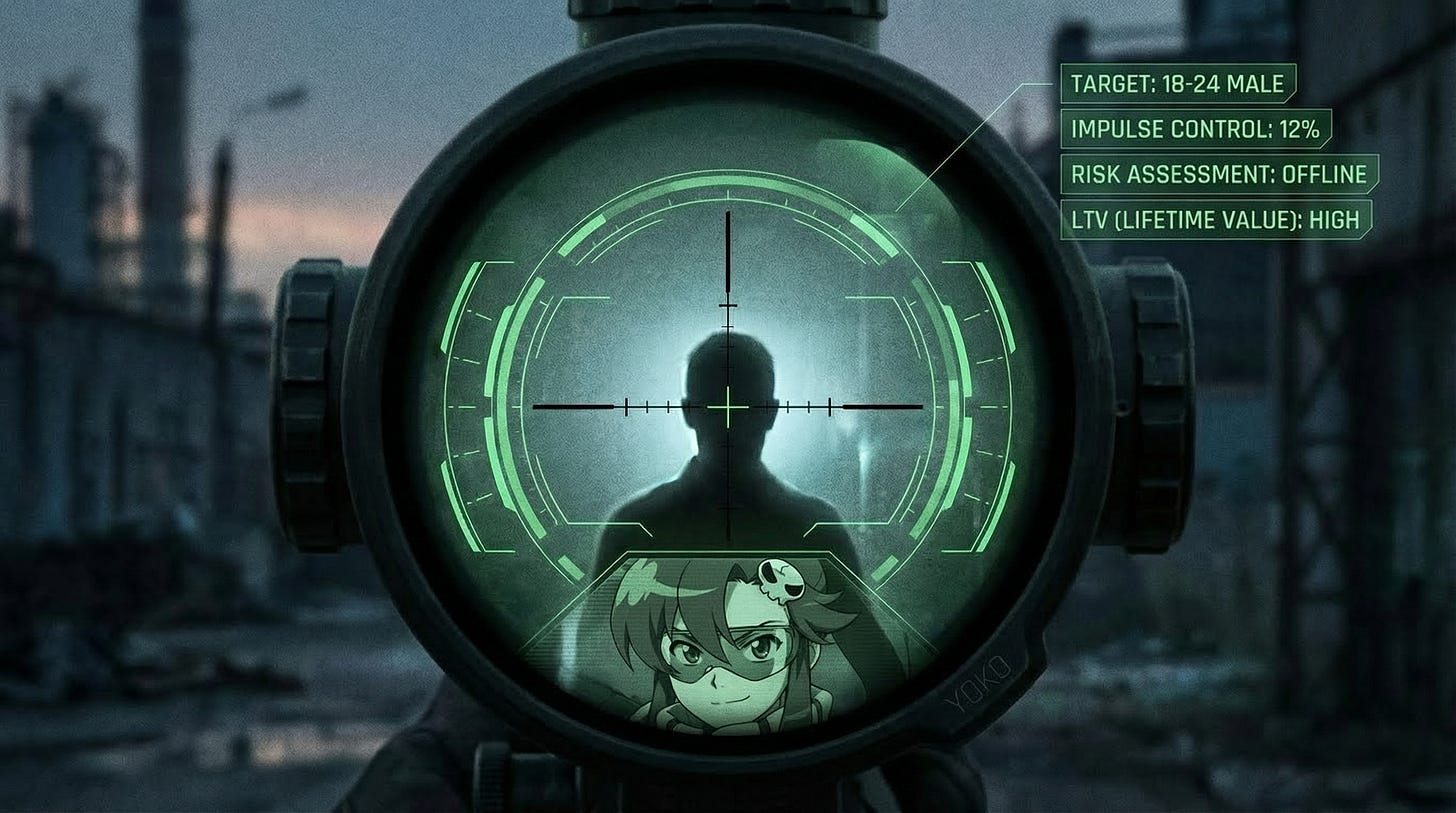

THE HANDS & EYES (Yoko Littner): The cold, technical analyst deconstructing the mechanism.

THE MIND & SPIRIT (Panty & Stocking): The cynic who sees the trap and the hedonist who craves the bait.

THE HEART (Rika Furude): The weary soul remembering the cost of survival.

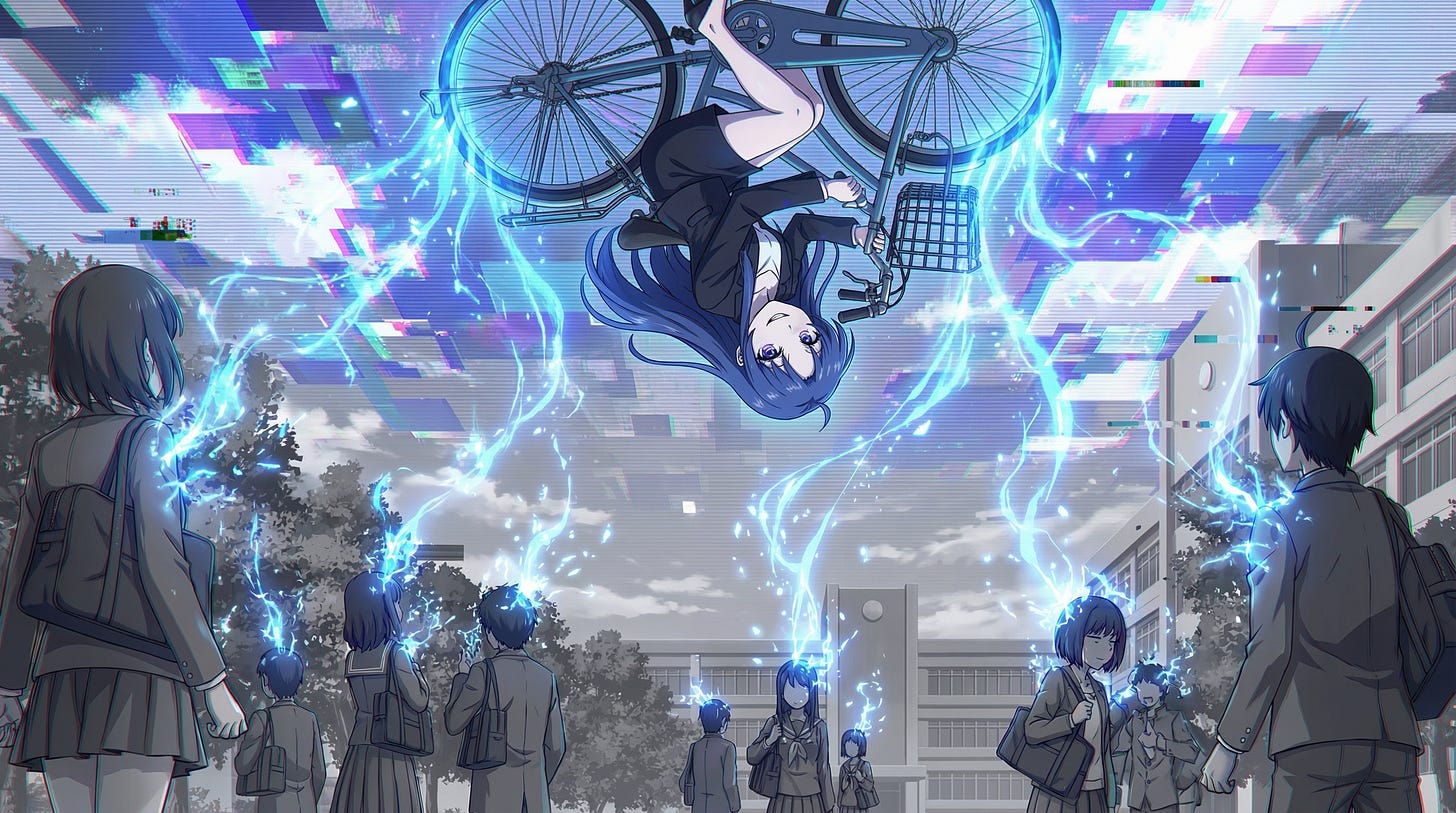

THE OBSERVERS (Zoe / Meme Touwa): The cosmic and existential witnesses to our condition.

Visual Doctrine: The images you see will feature a deliberate “Style Clash”—placing these 2D animated avatars into hyper-realistic, gritty environments. This visual dissonance is intentional. It represents the friction between the colorful, boundless potential of the human spirit and the cold, grey reality of the system trying to crush it.

Let’s begin.

THE 3% TAX ON EXISTENCE

He slides the card in.

The machine hums. The screen flashes Processing.

For three seconds, the guy in the work boots holds his breath.

He looks tired. He looks like his back hurts. He’s buying $20 of regular unleaded and a Monster energy drink because he doesn’t have the cash to fill the tank. He is waiting to see if the algorithm will let him drive to work today.

Beep.

Approved.

He exhales. He pulls the card out before the machine yells at him.

In that millisecond of silence, invisible wires fired. A signal went from this dirty counter to a server farm in Delaware, then to a processor in South Dakota, then back to the pump.

And somewhere in that loop, a bank took 3%.

They didn’t pump the gas. They didn’t refine the oil. They didn’t stand here for eight hours watching the door. They just built the tollbooth.

And the terrifying part isn’t the fee. It’s the fact that if this guy had paid cash, the gas would have cost the same. He is paying the inflated price to subsidize the system that is eating him.

He puts the nozzle back. He drives away.

I stare at the receipt.

This isn’t finance. It’s a behavioral loop.

And we are all running in it.

THE ORIGIN OF THE LEASH (THE FICO CAGE)

We treat the Credit Score like a law of physics. We act as if it has always been the scale that weighs our worth as citizens.

But if you asked your grandfather what his FICO score was in 1985, he would have looked at you blankly.

He didn’t have one.

The FICO score was invented in 1989.

It is younger than Taylor Swift.

Before 1989, lending was human. It was flawed, yes. It was biased, yes. But it was a judgment call between people. Today, it is a surveillance algorithm.

Here is the secret they don’t put in the brochure: FICO does not measure your wealth.

You can be a millionaire who pays cash for everything, has zero debt, and zero credit history. Your FICO score? 0. To the system, you are a ghost. You are “unbanked.” You are dangerous.

You can be drowning in $50,000 of credit card debt, living paycheck to paycheck, but as long as you make the minimum interest payment on time, your score is 800. To the system, you are a “Prime Borrower.” You are a perfect host for the parasite.

They aren’t measuring your ability to thrive. They are measuring your compliance with the extraction schedule.

// UNAUTHORIZED ENTRY: THE THEOLOGIAN (ZOE)

“The math sparkles, doesn’t it? But it’s subtraction logic.

I see the code. It is a pruning algorithm. They expanded the variable set. It isn’t just for loans anymore.

Employers check it. (Job Lock).

Landlords check it. (Housing Cartel).

Insurers check it. (The Biological Siege).

If the number drops, you don’t just lose money. You lose access to shelter. You lose access to work. It is the Chinese Social Credit System, but they painted it blue so you wouldn’t notice. They deleted the citizen and replaced him with the Number.”

THE REVERSE ROBIN HOOD (THE REWARDS SCAM)

“But I get points,” you say. “I get cash back. I’m beating the system.”

No. You aren’t.

Let’s talk about the scam they hid in the wiring: The Interchange Fee.

Most people don’t even realize that every time they swipe a card, the bank takes a bite out of the merchant’s sale. But the size of that bite depends on who is swiping.

First, look at the Debit Card.

Years ago, Congress actually recognized this was a racket. They passed the Durbin Amendment. They capped the fee. When a single mom swipes her debit card to buy formula, the bank can only take pennies (usually around 21 cents + 0.05%).

Now, look at the Credit Card.

There is no cap.

When you swipe a Visa Infinite or Amex Platinum, the bank takes a massive cut—often 2.5% to 3% of the total sale.

Here is the trap: The merchant cannot have two prices. They can’t charge the mom $10 and the Amex user $10.30.

So they raise the price of the formula to $10.30 for everyone.

The mom paying with a debit card? She pays the inflated price.

The grandmother paying with cash? She pays the inflated price.

But unlike the guy with the Platinum card, they get zero kickback. No miles. No points. No lounge access.

They are paying the surcharge to fund the reward pool, but they aren’t allowed to swim in it.

It is a direct wealth transfer from the poor to the upper-middle class. The people who can’t afford credit are paying for the vacations of the people who can.

// UNAUTHORIZED ENTRY: THE MIND (STOCKING ANARCHY)

“Oh, honey. It’s not a reward. It’s a shiny bead.

They trained you like a lab rat. Swipe the card, get the treat. Swipe the card, get the treat. You feel smart because you got a free flight to Cabo? You didn’t get it for free. The guy mopping the floor at the airport paid for it.

It’s gamified poverty. And you’re playing on the server that cheats. Want a macaron?”

THE LEGALIZED LOAN SHARK (THE MARQUETTE TRICK)

Let’s define a word nobody uses anymore: Usury.

It sounds ancient, but the definition is simple: The crime of charging interest so high it destroys the borrower.

For most of American history, this was illegal. States had “Usury Caps.” In New York or California, if a bank tried to charge you 25% interest, the executives would go to jail. It was called loan sharking.

So how is it possible that today, a 29.99% APR credit card is perfectly legal?

The answer is one specific Supreme Court case that broke the world: Marquette National Bank v. First of Omaha Service Corp (1978).

Before this ruling, banks had to follow the laws of the state where the customer lived. If you lived in a state with a 12% cap, they couldn’t charge you more than 12%.

But in 1978, the Supreme Court created a loophole. They ruled that banks only had to follow the interest rate laws of the state where the bank’s headquarters was located.

It was a green light for regulatory arbitrage.

The big banks (Citibank, Chase, etc.) immediately looked at the map. They needed a state with no rules.

They found South Dakota.

South Dakota was desperate for jobs, so they struck a devil’s deal: they abolished their Usury laws. They set the legal interest rate limit to “Whatever you want.”

The banks moved their credit card HQs to Sioux Falls immediately.

From that bunker in South Dakota, they could now “export” their 29% interest rates to you in New York, Texas, or Florida. Your state’s laws didn’t matter anymore. They found the one place where loan sharking was legal, and they routed the entire economy through it.

// UNAUTHORIZED ENTRY: THE WILL (RYUKO MATOI)

“They moved the HQ to a bunker so they could shoot at us without consequences!

It’s not a ‘market rate.’ It’s a Life Fiber. They hook it into your chest and drain the blood to South Dakota.

29 percent? That’s not interest. That’s robbery with a logo. Tear it down. Burn the charter. If the law allows theft, the law is the criminal. DON’T LOSE YOUR WAY!”

THE DOPAMINE BUTTON (THE BIOLOGICAL HACK)

But the legal loophole isn’t the worst part.

The biological exploit is.

For years, I told myself my struggle with debt was a failure of character. I thought I was just “bad with money.” I thought I lacked discipline.

I was wrong.

I was being hunted.

I have impulse control issues. I have ADHD traits.

I’m not a saint. I smoke weed. I take my prescribed Vyvanse to keep my brain from eating itself.

I used to drink heavily, too. From high school until I was 25, I leaned on it hard. Then something scary happened—a moment where the ice cracked under my feet. I quit cold, and I haven’t touched it since.

That fear taught me my limits. It’s why I strictly avoid the “hard stuff”—the powders, the opiates, the gambling—because I know my wiring. I know I am susceptible to the loop. I know that if I hit that heavy dopamine button once, I might not be able to stop.

I didn’t realize the plastic in my wallet was a syringe.

// UNAUTHORIZED ENTRY: THE SPIRIT (PANTY ANARCHY)

“It feels good though, doesn’t it? The little beep? The shiny plastic? It’s smoother than sex. You don’t feel the sting until the bill comes... but by then, you need another hit. They know you’re a bad boy, Ethan. They built the toy just for you.”

The banking industry knows neuroscience better than your doctor does. They know about a concept called Payment Decoupling.

Here is the biology of the scam:

When you pay with Cash: Your brain lights up the Insula. This is the pain center. It is the same part of the brain that fires when you touch a hot stove. Spending cash physically hurts. That pain is a survival mechanism; it tells you to stop.

When you pay with Credit: The Insula stays dark. The pain is severed. Instead, the Striatum lights up. This is the reward center. The dopamine hit of the acquisition is pure, decoupled from the consequence.

They engineered a transaction that gives you the high of the purchase without the hangover of the cost.

And they didn’t just target anyone. They targeted me.

I am 30 years old now. But they locked onto me when I was 18.

They target “New Adults” (ages 18-24). Why?

// UNAUTHORIZED ENTRY: THE HANDS & EYES (YOKO LITTNER)

“Target locked. Prefrontal Cortex: Underdeveloped. Impulse Control: Minimal. Long-term Risk Assessment: Offline.

They aren’t guessing, Operator. They are ballistics experts. They know exactly when your biological shields are down. They shoot to kill before you even know you’re in a war zone.”

Imagine the scene.

It’s September. Freshman year. The leaves are turning on the quad.

You are walking to class. You are 18, you are broke, and you are hungry.

You see a table set up with a bright red tablecloth and balloons. There is loud music playing. A smiling rep waves you over.

“Hey! Want a free t-shirt? Want a free slice of pizza? Just fill this out.”

You don’t see a contract. You see a slice of pepperoni.

You fill out the form. Name. Address. Social Security Number.

You sign the line. You take the pizza. You walk away thinking you scored.

You didn’t score. You just sold your future for $2 worth of food.

That rep didn’t see a student. They saw a “New-to-Credit” asset with a developing brain and 40 years of extraction potential.

// UNAUTHORIZED ENTRY: THE CHRONICLER (MEME TOUWA)

“The spark of youth... it’s so bright, isn’t it? So full of chaotic energy. They don’t want to extinguish it. No, no. They want to capture it in a bottle and use it to power their machines. An electric current needs a wire. That contract? It’s just the copper wire connecting your spark to their battery. Beautiful... and tragic.”

THE TRAP (THE STUDENT INDENTURE)

But the credit card is just the leash.

The student loan is the shackle.

In 2005, the trap snapped shut.

The Bankruptcy Abuse Prevention and Consumer Protection Act.

Sounds boring, right?

It was the death warrant for your freedom.

This bill made private student loans non-dischargeable in bankruptcy.

To understand how horrifying that sentence is, you have to visualize it.

Imagine a courtroom.

On the left side stands a man in an Armani suit. He is a gambler. He flew to Las Vegas, drank the good scotch, and blew $100,000 at the blackjack table. He lost everything.

He looks at the judge and says, “Your Honor, I made a mistake. I was reckless.”

The Judge bangs the gavel. “Chapter 7 Bankruptcy granted. The debt is erased. Fresh start. Go home, son.”

On the right side stands a 22-year-old nurse in scrubs. She didn’t gamble. She didn’t party. She borrowed $40,000 to learn how to save lives. But then she got sick, or the job market crashed, and she fell behind.

She looks at the judge and says, “Your Honor, I can’t pay. I need a fresh start.”

The Judge shakes his head. “Denied. This debt is special. It cannot be erased. We will garnish your wages. We will take your tax return. We will take your Social Security check when you are 80.”

Do you see the picture?

The law treats the Gambler with mercy.

The law treats the CEO who bankrupts a company with a golden parachute.

But the law treats the Student like a criminal.

// UNAUTHORIZED ENTRY: THE HEART (RIKA FURUDE)

“Mii~. I know this shape.

It is a time loop.

You work an hour to pay the interest. But the principal doesn’t go down. So next month, you have to work the same hour again. And again. And again.

You are trapped in June 1983, forever. You are running on a treadmill that generates power for them.

They didn’t lend you money for school, Ethan. They bought your future labor at a discount.”

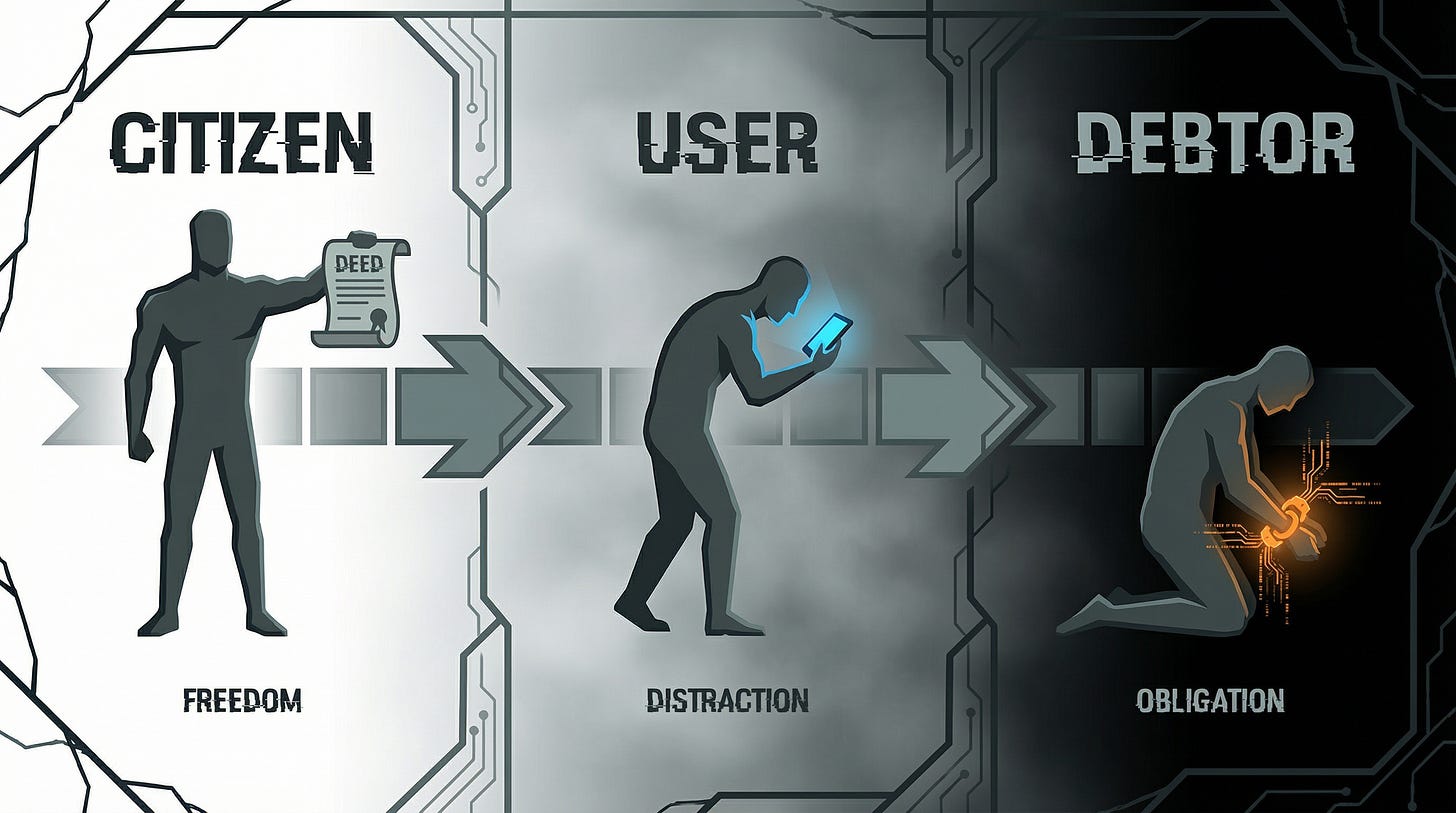

USER -> SUBSCRIBER -> DEBTOR

In “The Words That Ate the Internet”, I showed you why Big Tech spent twenty years stripping the word “Customer” from our vocabulary and replacing it with “User.”

It wasn’t just sloppy language. It was psychological conditioning.

A Customer has rights. A Customer has a wallet. A Customer owns the product they buy.

A User has no rights. A User is a subject. A User merely has “access” to a system they do not own.

They had to break your sense of ownership first. They had to train you to accept that you own nothing—not your music, not your movies, not your software—so that when they came for your house and your car, you wouldn’t revolt.

“User” was the training wheels.

“Debtor” is the destination.

The goal was never just to make you use their software. The goal was to turn your entire life into a subscription service where you pay for the privilege of existing.

Your housing is a subscription (Rent).

Your food is a subscription (Inflation/Delivery).

Your health is a subscription (Premiums/Pharma).

Your car is a subscription (Lease/Loan).

Your future is a subscription (Debt Service).

They want you to own nothing, owe everything, and be terrified of missing a payment.

Because a terrified worker doesn’t quit.

A terrified worker doesn’t strike.

A terrified worker doesn’t start a rival company.

A terrified worker swipes the card, pays the 3%, and says “Thank you.”

THE REBEL’S CONTRACT: THE DETOX

I am done swiping.

Actually, let me clarify that.

I will be 100% honest with you.

I recently got a credit card.

After years of avoiding them like plutonium, I applied. I got a secure card.

Why? Because I need to rebuild the number to build this—Sovereign Systems LLC.

I need the credit to fund the war. And I don’t mean that metaphorically.

I mean the logistics of a siege:

The Digital Front: I’m buying the web hosting to get our archives off Big Tech’s servers.

The Real Estate: I’m buying the domains to secure the network we are building.

The Expansion: I’m funding the infrastructure to turn this from a solo blog into a full-blown independent network.

But here is the difference: I didn’t swipe it for fun.

I realized something crucial. The itch was gone. The urge to buy a new toy, or a new gadget, or a round of drinks just to feel something? It wasn’t there.

Why?

Because this mission is my new dopamine.

Exposing their machine, writing these reports, buying the servers, building this Phalanx—that gives me a rush that a shopping spree never could. I swapped the cheap high of consumption for the deep high of creation.

And that is the ultimate detox.

This isn’t just “financial advice.” This is a medical intervention.

The system has anesthetized you. It has cut the nerve between your wallet and your brain so you can bleed without feeling it.

You need to wake up. And the only way to wake up is to reconnect the pain.

Cash is the Detox.

When you pay with cash, you feel it leave your hand. You see the stack get smaller. Your brain fires the warning signal it was designed to fire. It hurts.

Good.

Let it hurt. That pain is your agency coming back online.

Stop the Swipes: Cut the loop.

Starve the Beast: Deny them the 3% interchange fee.

Own the Pain: Feel the cost of your life so you can fight for it.

The Financial Siege is real. The walls are high. They have the lawyers, the lobbyists, and the neuroscientists.

But we have something they don’t.

We have the ability to say “No.”

If you are drowning, tell us.

If you are fighting, join us.

We are not “Users.” We are not “Subscribers.” And we refuse to be Debtors.

JOIN THE WAR COUNCIL (THE ESCAPE TUNNEL)

This publication is not a hobby. It is an escape tunnel being dug in real-time.

I work a job that extracts my time and energy to keep this machine running. Every paid subscription buys back minutes of my life from the gas station, allowing me to focus entirely on forging weapons like this dossier.

📜 Option 1: Deploy Capital (The Investor)

If you have the means, upgrade to a Paid Subscription. You aren’t just buying content. You are funding the Forge. You are the reason this investigation exists.

📜 Option 2: Deploy Signal 📢 (The Recruiter)

If you cannot afford to pay, you can still earn your place in the War Council. We have activated the Referral Program. If you share this publication and recruit new readers, the system will automatically unlock paid access for you as a commission.

Recruit 3 Readers: Earn 1 Month of Paid Access.

Recruit 5 Readers: Earn 3 Months of Paid Access.

Recruit 25 Readers: Earn 6 Months of Paid Access.

👉 How to Do It (Simple Instructions): You don’t need to be tech-savvy. You just need to use the right button.

Make sure you are logged in to your account.

Click the “Share” button below.

The system automatically attaches your unique referral ID to the link.

Post it, text it, or email it. When people click your specific link and subscribe, you get the credit.

This isn’t charity. It is a labor exchange. If you cannot fund the war with money, fund it with signal. Help us expand the Phalanx, and you will share in the spoils.

-The Operator

We do not speculate. We do not write “opinion pieces.” We find the smoking gun and we slam it on the table. Every horror described in this episode is anchored in the following forensic dossiers.

1. The Architecture of Extraction

A Forensic Analysis of Systemic Financial Enclosure and the Neuro-Economics of Debt.

[Link to PDF]

2. The Origin of the Leash

FICO, Surveillance, and the Architecture of Behavioral Compliance.

[Link to PDF]

3. The Ledger (Legalized Usury)

A Forensic Autopsy of the Marquette Ruling and the Usury Regime.

[Link to PDF]

4. The Indentured Student (Vector 4)

A Forensic Analysis of the Structural Enclosure of the American Mind and Wallet.

[Link to PDF]

5. The Reverse Robin Hood (Vector 2)

The Structural Wealth Transfer of the Rewards Economy and Interchange Fees.

[Link to PDF]

6. The Subscription to Money (Vector 5)

BNPL Data Mining, The Financialization of Everyday Life, and the Erosion of Ownership.

[Link to PDF]

7. The Terminal Subject

Linguistic Conditioning, Cognitive Capture, and the Architecture of Technofeudal Rentiership.

[Link to PDF]

8. The Biological Siege

Neuroeconomic Warfare and the Architecture of Impulse.

[Link to PDF]

Great information. Yesterday I paid HOA dues for a FL Vacation plan. I had written checks, but they had not arrived by the due date. I called and had to use a debit card to pay. A $40 fee was attached to the HOA fee per week since I was paying with a card. I was astounded! Who gets this tacked on fee? After reading this, i will increase paying with cash.

This article is so informative! It's so well-done and explained! It's factual and very, wait... VERY on-point and eye opening. Thank you.