WoI EP4: Why Your Electric Bill is a Bank Bailout

THE WAR ON ILLUSION: EPISODE 4 - THE VAMPIRE GRID

THE COLD OPEN: THE LIFE-SUPPORT POD

It is February 14th. The temperature outside is 12 degrees.

And then the silence hits.

In the old world—the world of your grandparents—a power outage was an inconvenience. You lit a candle. You threw a log in the wood stove. You cooked on the gas range. You called your neighbor on a copper-wire landline that carried its own voltage. The house was a fortress with multiple, redundant lifelines.

But you don’t live in a fortress anymore.

You live in a “Smart Home.”

And when the silence hits today, it feels different. It feels like the airlock just opened.

In the electrified future they are building for you, the silence is total.

Your heat pump dies and the house instantly begins losing the fight against the cold. Your induction stove becomes a sleek black brick on the counter. Your electric vehicle is locked in the garage at 12%—a two-ton paperweight. Your internet is dead, severing your connection to the Cloud, your bank, your job, your maps, your “support.” If you went fully ‘smart,’ you’ll learn real fast whether you kept the physical key…or whether your front door is now just another subscription endpoint that needs permission to work.

You haven’t just lost “power.”

You have lost your biology.

They remodeled your home from a shelter into a life-support pod.

It hangs from a single, fragile wire, suspended over a void of freezing temperatures.

And the people holding the other end of that wire?

They know exactly what that vulnerability is worth.

In the old world, electricity was a product.

In the new one, it’s permission.

And they are about to send you the bill.

THE MECHANISM

THE ROE SCAM (HOW ROT BECOMES A MORTGAGE)

To understand why the lights are flickering, you have to understand one simple, terrifying fact:

Your utility company does not make shareholder money by keeping your life stable.

In the United States, the monopoly utility operates under a perverse incentive structure most people never see because it lives in rate cases, spreadsheets, and footnotes. It has a polite name—Rate-of-Return Regulation—but the logic is brutal:

They are allowed to earn a guaranteed return on new infrastructure.

They earn essentially nothing on maintaining old infrastructure.

This is the split that defines everything.

OpEx (Operating Expense): Maintenance. Inspections. Tree trimming. Replacing small failing components. Boring work. Necessary work. The kind of work that keeps the lights on.

CapEx (Capital Expense): New build. New poles. New substations. New transmission. Big projects. Big invoices. Big rate base.

Here’s the part they don’t say out loud:

When the utility spends on CapEx, it can add that spending to the “rate base”—and then charge you not only the cost, but a legally authorized profit on top of it, for decades. That authorized return is often in the neighborhood of 9–10%. It’s the engine. It’s where the shareholder oxygen comes from.

So the system trains the utility to behave like a specific kind of animal.

A predator that doesn’t feed on electricity.

A predator that feeds on replacement.

If the utility sends a crew to inspect an old wooden pole, tighten bolts, replace worn connectors, and trim trees around it—that’s maintenance. That costs money. It doesn’t create a shiny asset. It doesn’t swell the rate base. It doesn’t juice earnings.

So they starve it.

But if they let that pole rot?

If they let the termites eat it until it snaps in a windstorm… if it sparks a wildfire… if it knocks out a neighborhood…

Then a replacement project gets approved.

And replacement is CapEx.

And CapEx is a mortgage the utility gets to write in your name.

This is why your bill rises while reliability falls. This is why every “upgrade” sounds like a rescue mission but feels like a ransom note. This is why the system can watch the grid decay and still call itself “responsible.”

Because under this model, the grid is not a public trust.

It’s a quarry.

And you are not a customer.

You are the rate base.

Here’s the horror you’re supposed to miss:

Every outage isn’t just a failure. It’s an authorization event.

Every snapped line is a pretext.

Every blown transformer is a new loan.

This is not a system designed to prevent collapse.

It’s a system designed to monetize it.

If you want a single phrase for the mechanism, make it this:

They don’t maintain the grid. They harvest it.

THE DIGITAL SOVEREIGN

THE NEW APEX PREDATOR

While the utility company is letting the grid decay into a replacement machine, a new species of predator has moved in.

We are witnessing the rise of what I’m calling: The Digital Sovereign.

You’ve heard the hype. “Generative AI.” “The cloud.” “Crypto.” “The future.” They’ll tell you it democratizes everything. They’ll tell you it’s magic.

They don’t tell you what it eats.

The Physics of Intelligence:

Here’s the twist that screws up every clean argument.

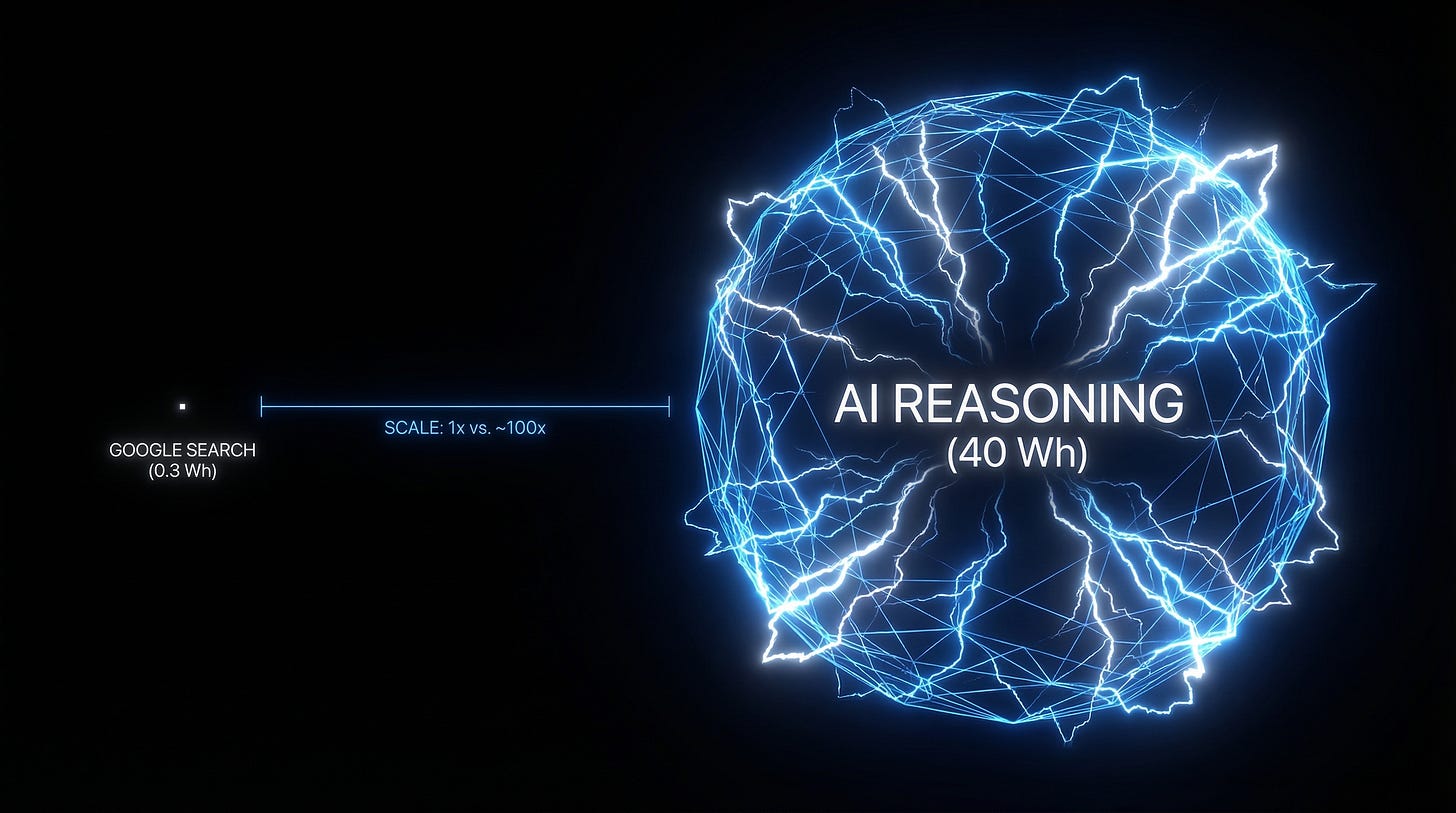

Early estimates pegged a ChatGPT-style query at ~3 watt-hours — about ten times a web search. That number went viral because it sounded like a crime scene.

But the machine got more efficient faster than the critique.

Updated 2024–2025 analysis suggests GPT-4o can be closer to ~0.3 watt-hours per query, roughly parity with search, while “heavy” reasoning queries can spike dramatically (think ~40 Wh when the model is actually chewing on something). The point isn’t that every prompt is a power plant.

The point is that the variance is real, and the volume has no natural ceiling.

And while pundits argue about your thermostat, the grid planners are staring at the real number: data center capacity demand projected to jump from ~30 GW in 2025 to ~90 GW by 2030…power on the scale of building a second California grid just to feed “the cloud.”

The Habitat Shift

The grid used to be designed for people. For factories that made physical things. For homes that cooked dinner. For towns that slept.

Now the grid is being bent around the Hyperscale Data Center.

In places like Northern Virginia (”Data Center Alley”) and Texas, utilities are bulldozing community concerns to build massive high-voltage transmission lines. These aren’t for you. They are “feeding tubes” for server farms that span millions of square feet, consume water like a mid-sized city, and hum with a deafening, industrial drone 24/7.

Then it gets darker.

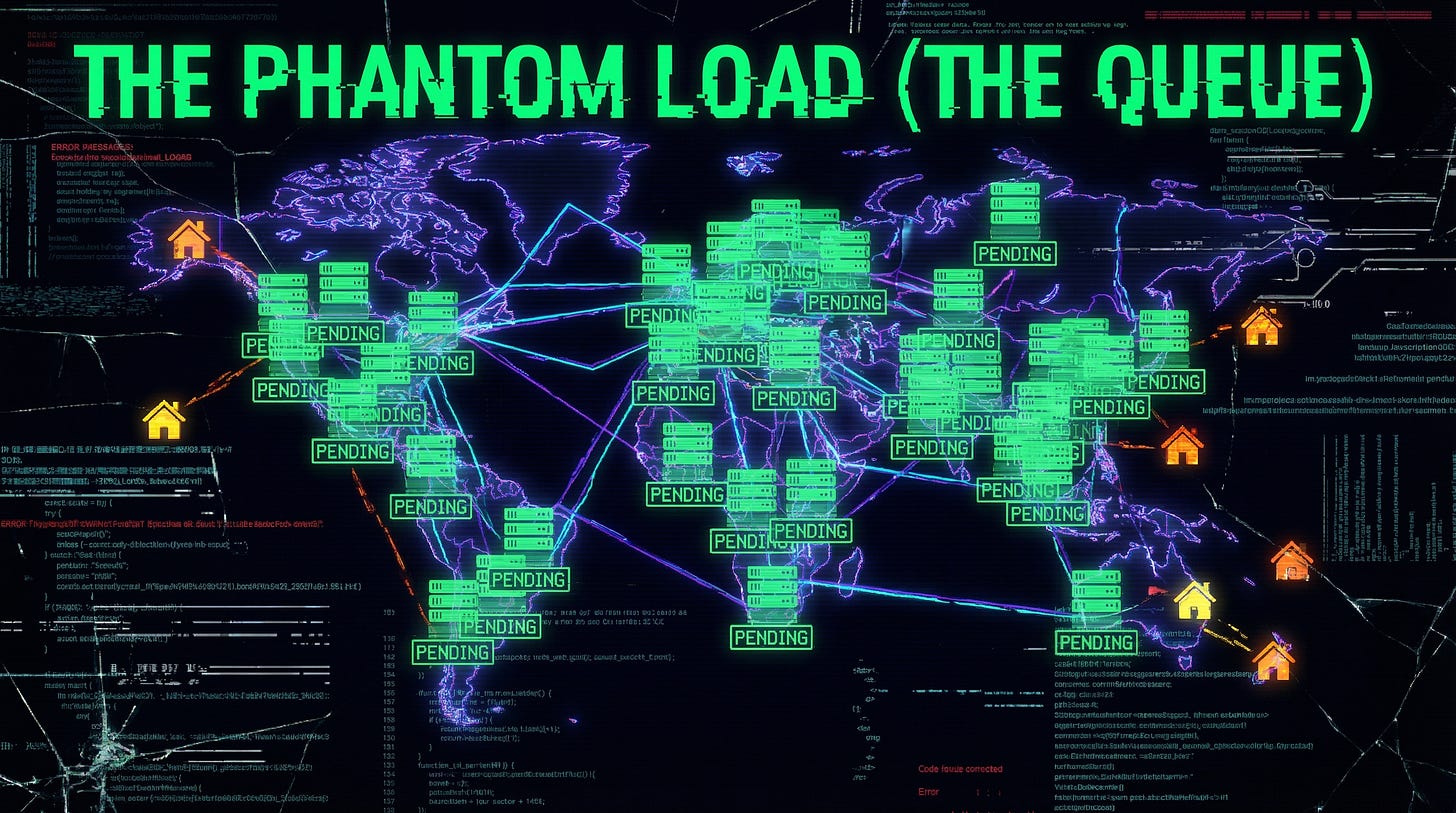

Developers know grid capacity is scarce. So they flood interconnection queues with speculative projects—requests for capacity they may never build.

Call it “phantom load.” Call it “queue hoarding.”

Call it what it is: squatting on electrons.

And here’s the key detail: utilities often socialize the costs of upgrades needed to support this demand tsunami. The public ends up funding the infrastructure required to host the sovereign’s feeding habits.

Which means you are being asked to finance the creature that outbids you for survival.

The Dominance Structure:

The Household is told to conserve, to be flexible, to accept interruptions as “responsible citizenship.”

The Sovereign negotiates exemptions, secures priority access, and triggers buildouts.

You are asked to “do your part.”

They are granted territory.

THE FRAGILITY TRAP

ELECTRIFY EVERYTHING

This is where the episode stops being just a corruption story and becomes a hostage story.

Knowing that the grid is rotting into a replacement machine (Part I), and knowing that the Digital Sovereign is spiking demand (Part II), the system decides to do something that would be insane if it wasn’t profitable:

They force households off redundant energy—and onto a single point of failure.

This is the “electrify everything” mandate.

Gas stoves become taboo. Gas furnaces become “dirty.” Electric vehicles become moral.

And they sell it like it’s about carbon.

But structurally? It’s about leverage.

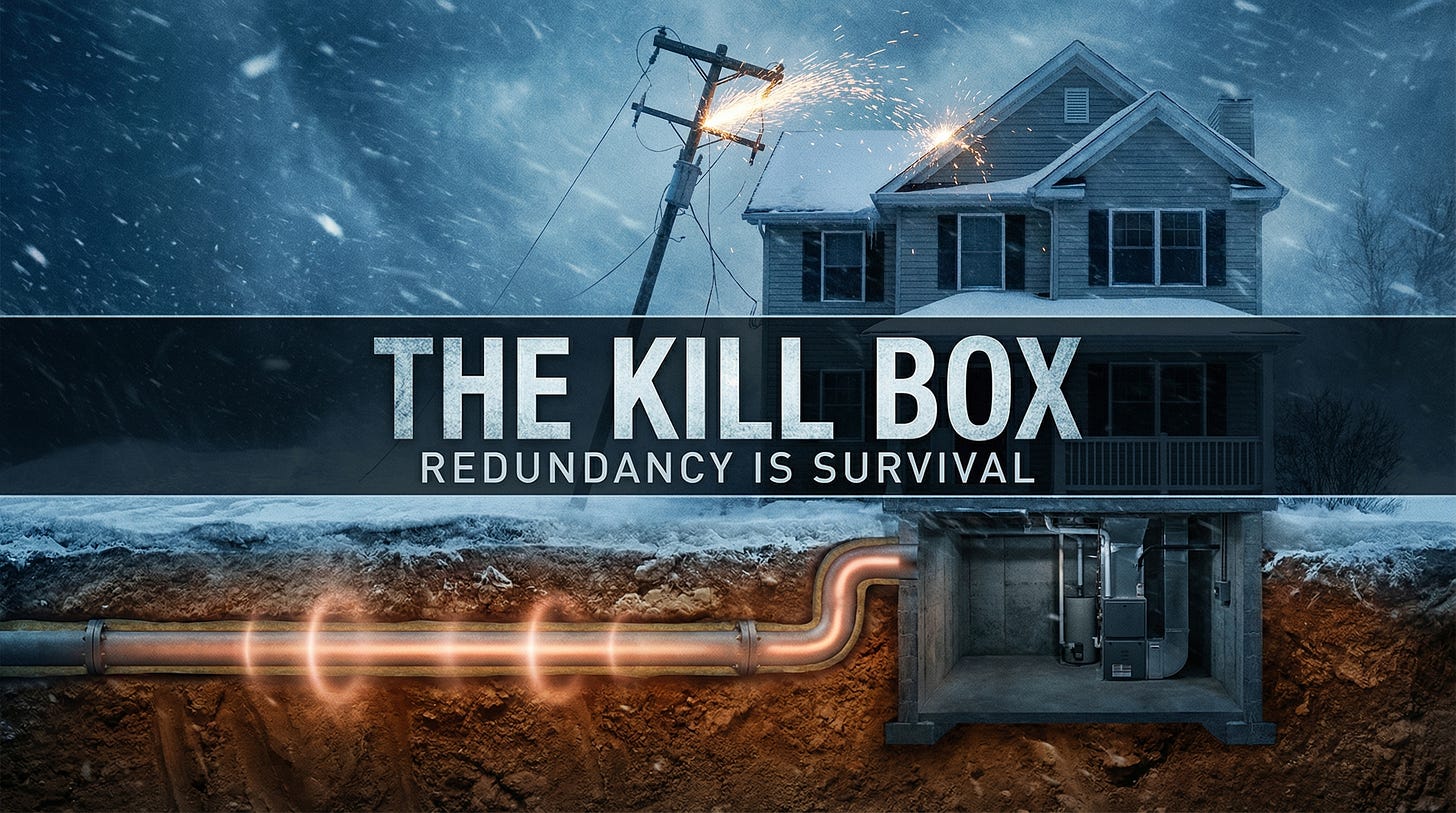

Because redundancy is what makes a home a home.

Remove redundancy, and you don’t just change appliances.

You change power.

You turn shelter into dependency.

You turn a house into a pod.

And a pod is governable.

Why “Two Networks” is a Shield

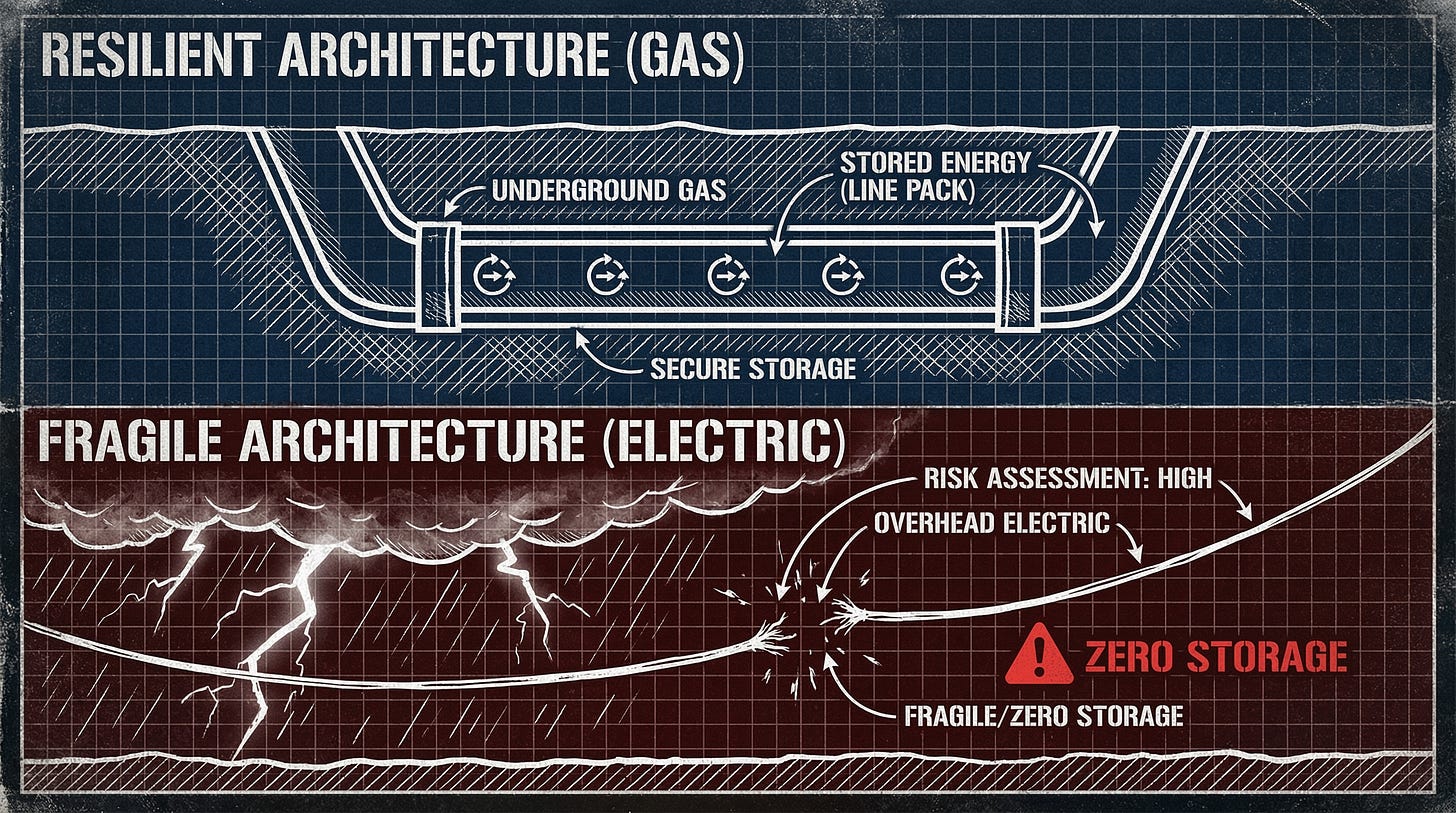

The Gas Network: Underground. Protected from wind/ice. Has “Line Pack” (pressurized storage). Resilient.

The Electric Grid: Overhead. Exposed to weather. Zero inherent storage. Fragile.

The Kill Box

Look at Winter Storm Elliott (2022) or Winter Storm Uri (2021). The pattern repeats:

People with redundancy survived longer.

Not because gas is magical — a lot of gas furnaces still need electricity for controls and blowers — but because a single-point failure system has a cliff edge. When the grid buckles, “all-electric everything” turns one outage into total thermal failure.

Meanwhile, gas distribution systems are mostly underground, carry inherent “line-pack” storage, and are typically engineered for very high reliability — which means redundancy buys time, options, and friction against collapse when weather turns the grid into a kill box.

In a mono-energy home, the moment the wire breaks, you lose your heat, your food, your transport, and your communication instantly.

That is not just inconvenient. It is biologically coercive.

You can be green. You can be safe. Under this model, you cannot be both.

THE FRAGILITY DIVIDEND

WHEN BRITTLE SYSTEMS REQUIRE TYRANNY

Here is the part you’re not supposed to say out loud:

You might think fragility is a mistake. An accident. Incompetence.

My analysis suggests fragility is a feature.

Because when you build a system that cannot tolerate stress, you create the justification for control.

The grid they’re building is too brittle to handle the demand they’re stacking onto it. The physics don’t add up without management. So management becomes policy. Policy becomes infrastructure. Infrastructure becomes authority.

And authority gets installed in your home.

They call it “smart.” They call it “efficiency.” They call it “grid modernization.”

But it looks like this:

Smart meters that report usage in real time.

Direct load control on thermostats and water heaters.

Demand response protocols that let the utility reach into your home and turn devices off during a “grid event.”

In the old world, you were a customer.

In this new world, you are a “flexible load resource.”

That phrase should chill you.

They don’t just want you electrified. They want you interruptible.

THE BANQUET

TAX EQUITY (EATING THE RECEIPTS)

So who is serving this meal?

Who benefits from the churn—tearing down working infrastructure, rebuilding fragile replacements, and layering control into the home?

Stop staring at the politicians.

Look at the Tax Equity Market.

The “green transition,” as implemented, isn’t just a climate program.

Structurally, it’s a tax-avoidance buffet.

It turns federal tax credits into transferable financial assets—and routes them through entities that have the tax appetite to consume them.

The Mechanism:

Banks and large corporate buyers fund renewable projects not primarily because they want to sell power to you, but because they want to harvest the credits, depreciation, and losses.

They do it through structures like the “partnership flip.”

It’s dessert engineering.

The project gets built. The tax benefits get allocated heavily to the tax equity investor until a target yield is achieved. Then the structure flips. The sugar gets eaten. The wrapper gets thrown away.

The Gluttons:

The “Big Three” in this ecosystem are the usual apex finance entities—JPMorgan Chase, Bank of America, Goldman Sachs.

They dominate because complexity is a moat. The more complicated the structure, the more it requires gatekeepers to structure, underwrite, and monetize it.

Insured Looting:

When utilities build big transmission projects, FERC Order 679 goes even further: it lets utilities include Construction Work in Progress (CWIP) in the rate base, meaning ratepayers bankroll projects before they’re operational.

And in the ugliest version of this incentive menu, regulators can allow 100% recovery of prudently incurred costs even for projects that get abandoned. The project can die mid-construction — and the bill still lives on your kitchen table.

A project can die, and the bill can live.

That’s not investment. That’s insured looting.

THE BIPARTISAN HANDSHAKE

THE PINCHER MOVEMENT

If you are reading this and thinking, “Ah, this is a Democrat scam because of the Green New Deal,” you are still in the Illusion. If you are thinking, “No, this is corporate greed caused by Republican deregulation,” you are also in the Illusion.

The Energy Trap is the ultimate bipartisan accomplishment. It is a pincer movement designed to crush the ratepayer from both sides.

The Blue Strategy (California/New York):

They provide the Moral Cover. They pass the “Electrify Everything” mandates. They ban the gas stoves. They create the “Climate Emergency” narrative that justifies the massive CapEx spending. They herd you into the fragility trap by telling you it is for the planet.

The Red Strategy (Texas/Ohio):

They provide the Industrial Cover. They deregulate the protections. They invite the Crypto Miners and Data Centers into rural counties with massive tax breaks. They pass legislation stripping local communities of the right to say “no” to transmission lines. They tell you it is for “Energy Independence” and “Jobs.”

The Reality: Look at the map.

California (Blue): Highest bills, massive fires, fragile grid.

Texas (Red): massive failures (Uri), bailout surcharges, fragile grid.

They scream at each other on cable news about “Windmills vs. Fracking.” But behind closed doors? They both take donations from the same Utilities. They both protect the 9-10% ROE. And they both vote to ensure that when the grid fails, you are the one who pays for the bail-out. The “Culture War” is the distraction. The “Rate Hike” is the consensus.

ONE GRID, ONE SWITCH

Stop listening to the climate war as it’s presented to you.

That fight is mostly a mask.

The reality underneath is mechanical, and it’s simple:

Utilities are rewarded for letting assets break and then rebuilding them as rate-base mortgages.

Data Centers are a new sovereign class spiking demand—and forcing buildouts that you help finance.

“Electrify Everything” strips households of redundancy and converts homes into single-point-of-failure pods.

The Tax Equity Market turns the whole transition into a dessert table where the biggest institutions eat the sugar and hand you the napkin.

This isn’t a clean-energy transition.

It’s a leverage transition.

One grid.

One switch.

One fragile wire.

And a bill that arrives wearing frosting…

…because the banks already ate the cake.

READ EPISODE 5 NOW:

📜 THE REBEL’S CONTRACT

INVEST IN THE GRID THAT DOESN’T BLINK.

If this report clarified the flickering lights in your life, consider honoring the Rebel’s Contract.

We do not hide the weapons behind a paywall. The Intel (This Report) and the Ammunition (The Research Packets below) are free for every citizen. We cannot build a Phalanx if we lock the doors.

But the Forge requires fuel. By subscribing, you are buying my freedom from the wage cage so I can spend my hours decoding our prison.

Free Subscribers: Get the “Glitch Reports” (Episodes) and the full Forensic Research PDFs.

Paid Subscribers ($7.76/mo): Get access to the War Room:

Inside the Forge: The tactical, behind-the-scenes logs of how we build these operations.

Fragment Methodology: My personal autobiography series mapping the psychological architecture of resistance.

The 2026 Expansion: Priority access to the massive content expansion launching in the New Year.

This isn’t a donation. It’s an energy transfer. You power the work. I map the exit.

(Verified Intelligence for the Phalanx)

1. THE MECHANISM (The ROE Scam)

The Source: 🔗 Utility Incentives and Data Center Demand (Packet 2).

The Fact: U.S. utilities operate under “Cost-of-Service Regulation” which incentivizes Capital Expenditure (CapEx) over Operating Expense (OpEx).

The Effect: This is known as the Averch-Johnson Effect—the tendency for regulated monopolies to over-invest in capital stock to maximize return.

The Smoking Gun: “Run-to-Failure” is an actual maintenance strategy where assets are allowed to operate until breakdown because replacement is capitalizable.

2. THE PREDATOR (Data Center Demand)

The Source: 🔗 Data Center Energy Demand & Grid Impact (Packet 3).

The Stat: Analysts are projecting a step-change: one major estimate frames U.S. data center power demand rising from ~30 GW in 2025 to ~90 GW by 2030 — and describes this as effectively building a “second California grid” to feed the cloud.

The Scale: Per-query energy is a moving target. Early figures put a ChatGPT-style query around ~3 Wh, but updated 2024–2025 analysis suggests GPT-4o can be ~0.3 Wh (near search parity), with complex reasoning queries spiking as high as ~40 Wh. The danger isn’t just “a prompt costs energy.” It’s that the system is building always-on baseload infrastructure for an appetite with no ceiling.

The Impact: Northern Virginia (”Data Center Alley”) requires the equivalent of several nuclear reactors worth of new capacity just to serve planned server farms.

3. THE TRAP (Fragility & Risk)

The Source: 🔗 Electrify Everything - Risk Assessment (Packet 4).

The Comparison: Natural Gas distribution lines are 90%+ underground and possess “line pack” (inherent storage). Electric distribution is largely overhead and has zero inherent storage.

The Event: During Winter Storm Elliott, the electric system showed how fast the cliff edge appears — with roughly 1.5 million outages reported. In PJM territory, analysis found the day-ahead peak-load forecast came in about 8% below the actual peak. That’s the kind of forecasting gap that turns “tight” into “catastrophic” when you stack EV charging, electric heat, and data center baseload on top of winter stress.

The Verdict: “Forced electrification creates a Single Point of Failure (SPOF) for residential life support.”

4. THE LOOT (Tax Equity)

The Source: 🔗 US Renewable Energy Tax Equity Forensics (Packet 1).

The Players: The market is dominated by JPMorgan Chase, Bank of America, and Goldman Sachs, who account for the vast majority of tax equity volume.

The Tool: The Inflation Reduction Act (IRA) introduced “Transferability,” allowing tax credits to be sold for cash, turning green subsidies into a liquid asset class for corporate balance sheets.

The Structure: The “Partnership Flip” allows banks to extract 99% of tax benefits in the early years of a project before “flipping” ownership back to the developer once the benefits are exhausted.

… In the electrified future they are building for you, the silence is total.

Your heat pump dies and the house instantly begins losing the fight against the cold. Your induction stove becomes a sleek black brick on the counter. Your electric vehicle is locked in the garage at 12%—a two-ton paperweight. Your internet is dead, severing your connection to the Cloud, your bank, your job, your maps, your “support.” If you went fully ‘smart,’ you’ll learn real fast whether you kept the physical key…or whether your front door is now just another subscription endpoint that needs permission to work.

Damn Good Article !! Wall Street Front Page!

I am quite frankly amazed at your level of research AND your careful analysis and conclusions. I have lived off grid, was born in Cuba which obtained some of the “modern conveniences” before the USA and developed systems (educational, healthcare, literacy level) which outdo by a HUGE amount US levels… and this despite 60+ years of a murderous economic embargo/blockade…

When I moved to California from Hudson County, New Jersey, the Poconos, Pennsylvania and earlier, Queens, New York, I was shocked, among other things, by the price of gasoline… The higher price of almost everything even though you farm it here and drill and so much else… And despite the fact that my house here in Alameda County has had solar panels forever, our utility bills have wiped out whatever savings I ever had. And when I tried to go off grid I was told that was a crime for which I could be prosecuted…

I practiced law in New Jersey for almost thirty years… As much as there were seriously corrupt judges and prosecutors, the level of corruption at EVERY level in California is quite possibly the worst I have ever experienced.

As is happening with those of us who expose genocide and corruption, telling the truth is not only a revolutionary act but one that may get you jailed or killed…

Bravo for your work.

PS I would have added Wells Fargo, which has long been one of the MOST corrupt banking institutions anywhere in the world.